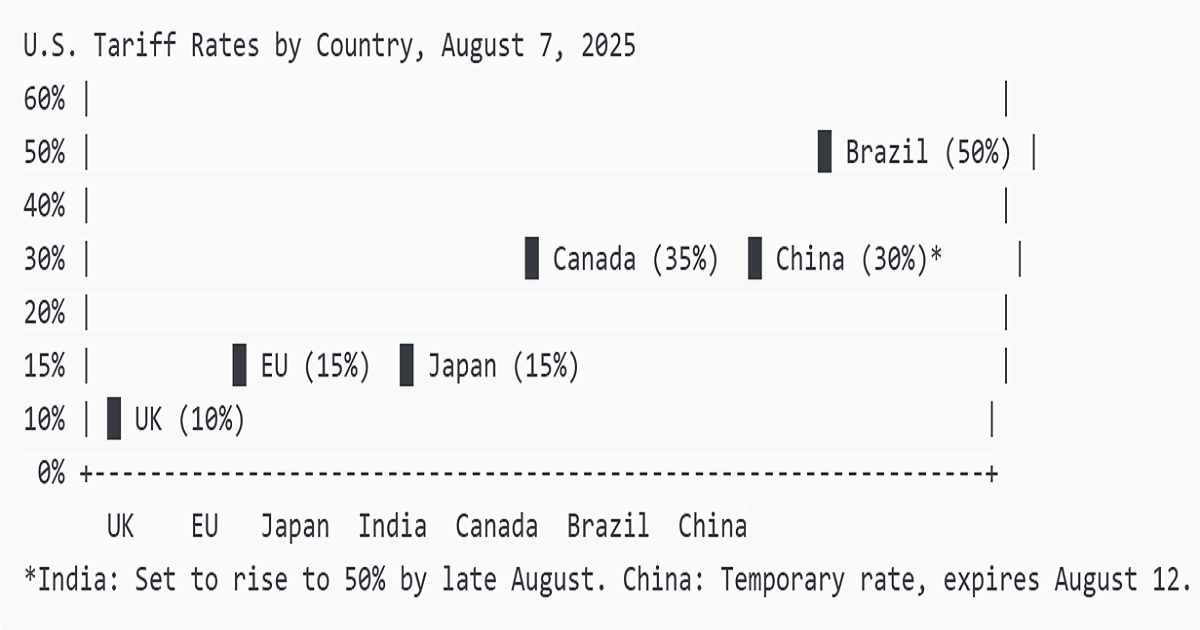

Hold onto your wallets, America’s trade landscape just got a seismic shake-up. As of midnight on August 7, 2025, President Donald Trump’s new “reciprocal” tariffs kicked in, slapping import taxes ranging from 15% to 50% on goods from over 90 countries. This is no small potatoes; it’s the highest tariff regime since the Great Depression, with the average effective tariff rate now sitting at a whopping 18.3%, up from 1.2% last year. But what does this mean for the average American sipping bourbon at the bar or scrolling through Amazon for deals? Let’s pour a double and break it down. The Tariff Lowdown Trump’s trade policy, dubbed “Liberation Day” when it first roared to life in April, is all about leveling the playing field or so the White House claims. The logic? If other countries tax U.S. exports, America hits back with matching or higher tariffs. The result is a complex web of country-specific duties: a baseline 10% tariff for nations with which the U.S. has a trade surplus, 15% for about 40 countries with trade deficits, and steeper rates for others. Brazil faces a 50% tariff (10% base plus a 40% penalty tied to its prosecution of former President Jair Bolsonaro), while India’s goods will hit 50% by late August for buying Russian oil. The European Union dodged a worse fate with a 15% deal, and Canada’s non-USMCA goods jumped to 35% as of August 1. China’s tariffs, meanwhile, are at 30% for now, down from a peak of 145%, thanks to a temporary truce expiring August 12.

Oh, and don’t forget the sectoral punches: 50% tariffs on steel, aluminum, and copper products, plus a 25% hit on auto parts. A 100% tariff on computer chips was announced August 7, promising to jack up prices on everything from iPhones to dishwashers. If it’s imported, it’s probably pricier now.

Why Now? The Trump Trade WarTrump’s been waving the tariff flag to boost U.S. manufacturing and shrink the trade deficit, arguing that foreign nations have been ripping America off for decades. His team points to $108 billion in tariff revenue collected in the first nine months of 2025, 5% of federal revenue up from 2% historically, as proof the policy’s working. But critics, including some Republicans, warn this is a sledgehammer approach that could backfire. The International Monetary Fund and OECD have slashed global growth forecasts, and the U.S. economy, while growing at 3% annually through June, is showing cracks: just 73,000 jobs were added last month, and markets slumped as tariffs loomed.

Trump’s also playing geopolitics. The 50% tariff on Brazil is as much about Bolsonaro’s legal troubles as trade. India’s penalty is a jab at its Russian oil purchases, tying trade to the Ukraine conflict. And Canada’s 35% rate (with 50% on metals) stems from disputes over fentanyl and a now dropped digital services tax. These aren’t just economic moves; they’re power plays.

Who Pays the Price? Here’s the kicker: tariffs are taxes, and you’re likely footing part of the bill. Goldman Sachs estimates 49% of the tariff burden falls on U.S. consumers, 39% on businesses, and only 12% on foreign exporters. Prices are already creeping up—2.7% inflation in June, with clothing, coffee, toys, and appliances leading the charge. That bottle of French wine or Italian gin at your local bar? Expect a 20-25% price hike, thanks to the EU’s 15% tariff. Your next car could cost $5,800 more, and Conagra Brands (think Hunt’s tomatoes and Reddi-wip) says tariffs will add $200 million to its costs, some of which will hit your grocery bill.

The Budget Lab at Yale projects these tariffs will cost the average U.S. household $1,300-$2,700 in 2025, with low-income families hit hardest—three times the burden of the top 1%. Long-term, they predict a 0.4% smaller economy and 494,000 fewer jobs by year’s end. But Trump’s team argues the pain’s worth it to bring manufacturing back home.

Winners and Losers Who wins? U.S. manufacturers in protected sectors like steel and autos might see a boost, with manufacturing output projected to grow 2%. Countries like the UK, with a 10% tariff rate, and Japan, at 15%, got off relatively easy. But consumers and importers are the big losers. Businesses like General Motors face $4-5 billion in added costs, and small retailers like Tribeca Wine Merchants are bracing for 30% price spikes on European wines by September. Even fast-fashion giants like Shein and Temu got slammed, with the de minimis exemption for low-value shipments axed for China and Hong Kong, and fully eliminated by August 29.

What’s Next? The tariff saga’s far from over. Trump’s signaled more levies are coming, with semiconductors, pharmaceuticals, and aircraft under review. China’s truce ends August 12, and Mexico’s 90-day grace period runs out in October. Markets are jittery—stocks surged when tariffs were paused in April but tanked as August 7 neared. The U.S. dollar’s taken a hit, and global trade’s in chaos, with retaliatory tariffs from Canada, China, and others looming.

For now, businesses are scrambling to stockpile goods, shift suppliers, or pass costs to you. Importers are urged to audit tariff exposure and explore nearshoring, but that’s easier said than done. As one trade expert put it, “Stop reacting. Start outmaneuvering.” Good advice, but when your bourbon’s suddenly 20% pricier, it’s hard not to feel the squeeze.

So, raise a glass to America’s new trade war—just don’t be surprised when the tab stings a bit more. Stay tuned to The Political Bourbon for updates on how this plays out, and let us know your thoughts in the comments. Are tariffs a bold move to restore American greatness, or a recipe for economic heartburn?